Contents:

Indicate how long you’ll be using it and if you’d want to be alerted ahead of time. Make any changes to the email message to your customer, then Send and close. From the Payment method▼ dropdown menu, select Check or QuickBooks Payment – Bank.

Is not authorised by the Dutch Central Bank to process payments or issue e-money. An application under Electronic Money regulations 2011 has been submitted and is in process. We are not permitted to carry out regulated business activities. To pay your supplier bills with recurring ACH payments, you need a third-party app for bill pay and payables automation.

Get paid on time and stop chasing payments every month.

To edit your recurring template and the way your recurring transactions are entered, you’ll need to go to the Recurring Transaction List. As of now, they don’t have the option to open/run a report showing all recurring transactions of the current/upcoming quarter . The report only shows the previous date of the template/transaction created and the next date of the transaction.

To check for the recurring transactions or template created, you can open the Recurring Template List report. QuickBooks lets you send or receive ACH payments by processing one-time or recurring ACH payments. Although QuickBooks Desktop support gives steps to pay vendors with recurring paper checks, it doesn’t provide instructions for recurring vendor payments using ACH.

You can do this for any transaction except bill payments, customer payments, and time activities. We’ll show you how to set up and make the most of recurring templates. Manage Recurring Payments lets you view, edit, and customize reports for recurring transactions by customer. Click the customer name to view details and/or modify existing recurring payments.

How to Set up Payments for ACH Customers using Recurring Billing on Receipts?

EFTs that use eChecks for recurrent bill payments are known as recurring electronic ACH bank transfer payments. Learn how to create templates for recurring transactions in QuickBooks Online. All of these payments are automated and scheduled to go out usually on a monthly basis.

Likewise, you can accept a wide variety of payment methods, including credit cards, debit cards, and digital wallets. You’ll also get access to our full-service payment infrastructure. Easily get set up by customizing one of our prebuilt checkout pages. Or, use our developer-friendly APIs to add hosted payment fields to your website or app. There’s no cost for setting up an account in QuickBooks Payments.

Can anyone accept an ACH payment?

Dancing Numbers is SaaS-based software that is easy to integrate with any QuickBooks account. With the help of this software, you can import, export, as well as erase lists and transactions from the Company files. Also, you can simplify and automate the process using Dancing Numbers which will help in saving time and increasing efficiency and productivity. Just fill in the data in the relevant fields and apply the appropriate features and it’s done.

This New Payments Platform Might Transform How Rent Is Paid … – The Motley Fool

This New Payments Platform Might Transform How Rent Is Paid ….

Posted: Sun, 04 Dec 2022 08:00:00 GMT [source]

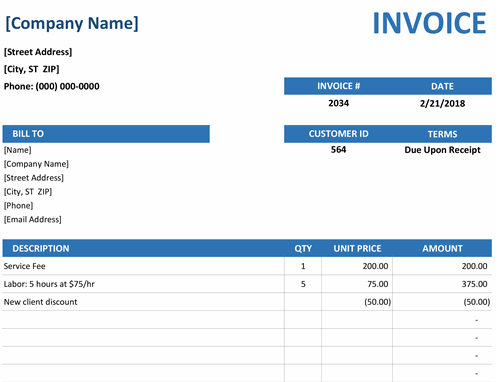

Click +New in the upper left corner, and then click Sales receipt under Customers. QuickBooks Online then opens a form that should look familiar to you. Select the Customer in the upper left corner and complete the rest of the fields as you would with any sales form. If you click Save and send when you’re done to email a copy to the customer, you can see a preview first. To accept payments remotely, you’ll need to get a free card reader from Intuit that attaches to your mobile phone.

How To Initiate an ACH Transfer

View the details of a recurring charge and then click the Delete button on the Payment Details tab. The record vanishes, and no more payments are made. You’ll need to go to the Recurring Transaction List to change your recurring template and the manner your Recurring transactions are recorded.

Wave Accounting Review: Is It Right for Your Business? – GOBankingRates

Wave Accounting Review: Is It Right for Your Business?.

Posted: Fri, 04 Nov 2022 07:00:00 GMT [source]

https://bookkeeping-reviews.com/ a good idea to look at this account occasionally to make sure you don’t have money just sitting there. There may be times when you provide a product or service for someone and they pay you on the spot. QuickBooks Online allows you to create and send sales receipts for just those occasions.

Any views expressed in this article are those of the author and do not necessarily represent those of Pay.com. Revenue Optimization Maximize your profits and grow your business.Accept Payments Now Easily accept payments on your website. QuickBooks Online supports all of these situations. It also provides a service that can automate your payments and help you get paid faster. To create a new recurring transaction, click the New button at the top right of this screen.

Pros and Cons of Accepting ACH Payments

Intuit Merchant Services enables payment processing through your linked merchant account through QuickBooks Payments for a modest transaction charge. Be sure you are using the right recurring transaction for your purposes. If you want to automatically process a client’s or a customer’s payment, use a recurring sales receipt. If you want to automatically send an invoice to the client and want them to execute payment themselves, use a recurring invoice.

- This saves you the time and hassle of bringing physical payment to the bank.

- There may be times when you provide a product or service for someone and they pay you on the spot.

- Reviewing this screen on a regular basis will help you catch any errors in the automated process.

- This process turns sensitive information into code, preventing any unauthorized use.

ACH payments offer a variety of notable benefits for both business owners and customers. Look at the end of the row for an invoice that hasn’t been paid. Click it to open the Receive Payment screen and complete the fields that aren’t already filled in, then save the screen. There’s also a Receive Payment link on the invoice screen itself.

- Nacha includes three separate time windows for Same Day ACH transaction processing.

- For merchants, the most exciting benefit is likely how affordable ACH payments are.

- This is why automation has become such an important strategy for modern businesses.

- QuickBooks Online then opens a form that should look familiar to you.

- The record disappears and no future payments are processed.

You can process a bank transfer payment now for an invoice or sales receipt. Or add your customer’s bank info to a recurring sales receipt. QuickBooks Online automated recurring ACH payments can be from/to your merchant bank account or using online sales receipts with a “Pay Now” button. That’s what makes QuickBooks such an important tool for every organization, big and small. You can set up recurring ACH payments for your bills and schedule ongoing customer payments.

Past per10 steps to effective conflict resolutionance is not indicative of future results. NerdWallet strives to keep its information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site. All financial products, shopping products and services are presented without warranty. When evaluating offers, please review the financial institution’s Terms and Conditions. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly.